Real Savings

When you shop and compare, you know you're getting the lowest rates and fees available. Lender competition leads to less money out of pocket at closing and lower payments every month. The infographic and information below is excerpted from the Consumer Financial Protection Bureau (CFPB) findings in their 2015 Consumer Mortgage Experience Survey. The CFPB found that shopping for a mortgage saves consumers an average of .5% on their interest rate. Using this information, the difference between a 5% and a 4.5% interest rate on a new home that costs $315,000 (with a $15,000 down payment and a financed amount of $300,000) is a Principal & Interest savings of roughly $90 per month. Over a typical 30 year amortized mortgage, $90 per month adds up to $32,400 in savings over the life of the loan.

Read more from the Consumer Financial Protection Bureau (CFPB) on how you could save thousands.

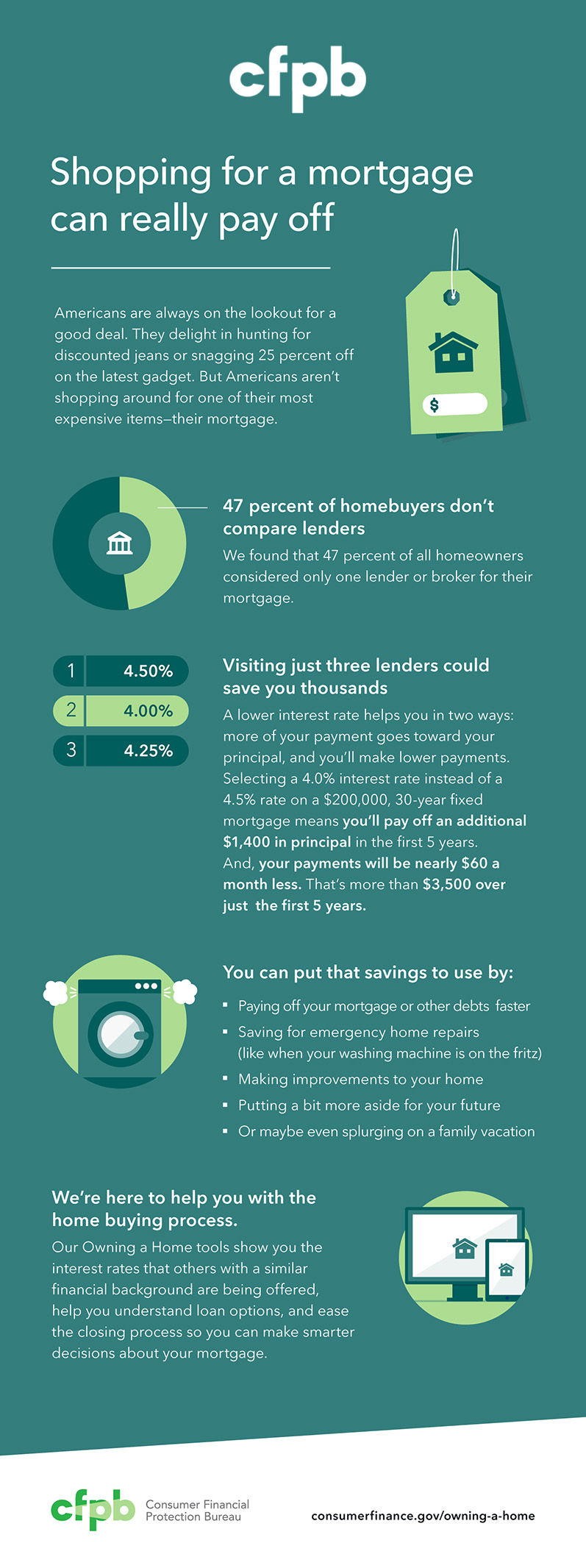

cfpb

Shopping for a mortgage can really pay off

Americans are always on the lookout for a good deal. They delight in hunting for discounted jeans or snagging 25 percent off on the latest gadget.

But Americans arent´t shopping around for one of their most expensive items-their mortgage.

47 percent of homebuyers don´t compare lenders

We found that 47 percent of all homeowners considered only one lender or broker for their mortgage.

Visiting just three lenders could save you thousands

A lower interest rate helps you in two ways: more of your payment goes toward your principal, and you´ll make lower payments.

Selecting a 4.0% interest rate instead of a 4.5% rate on a $200,000, 30-year fixed mortgage means you´ll pay off an additional $1,400 in principal in the first 5 years.

And, your payments will be nearly $60 a month less. That´s more than $3,500 over just the first 5 years.

You can put that savings to use by:

• Paying off your mortgage or other debts faster

• Saving for emergency home repairs (like when your washing machine is on the fritz)

• Making improvements to your home

• Putting a bit more aside for your future

• Or maybe even splurging on a family vacation

We´re here to help you with the home buying process.

Our Owning a Home tools show you the interest rates that others with a similar financial background are being offered,

help you understand loan options, and ease the closing process so you can make smarter decisions about your mortgage.

Consumer Financial Protection Bureau - cfpb

consumerfinance.gov/owning-a-home